Growth May Be Leveling, But Promo Continues To Trend Positive

The promotional merchandise market is standing on solid ground.

Last week at the PPAI North American Leadership Conference in Washington, D.C., Association President and CEO Dale Denham, MAS+, shared new PPAI data showing industry sales are on a healthy track in 2023.

The Recovery

It’s no secret that 2022 was a tremendous year for promo. PPAI’s research revealed that sales surged to more than $25 billion, a record for the industry, as it marked a decisive recovery from the pandemic-derived doldrums.

After slumping in 2020 during the height of the pandemic, the promotional products industry posted a rapid recovery.

- In 2021, sales rose at a brisk clip, climbing 12.5% in PPAI’s survey.

- The sales pace quickened in 2022, with PPAI’s 2022 Distributor Sales Volume Estimate reporting a 15.6% increase over 2021’s performance for the record $25.5 billion.

Nearly halfway through 2023, with the industry having regained its footing, indicators point to a growth rate that is slowing but still quite robust. Industry companies – including 4imprint, promo’s largest distributor – have shared similar stories of moderating growth.

Indicators Of Note

NALC opened last week with a few words from Denham, who shared data drawn from a panel built from respondents among the promotional products industry’s 100 largest suppliers. On aggregate, their responses were, in a word, positive.

PPAI Research asked the panel to say whether their orders were up in the second quarter of 2023 compared to the same period in 2023. Approximately two-thirds reported upward movement.

- Significantly increased – 12.5%

- Moderately increased – 54.2%

- Flat – 4.2%

- Moderately decreased – 29.2%

- Significantly decreased – 0%

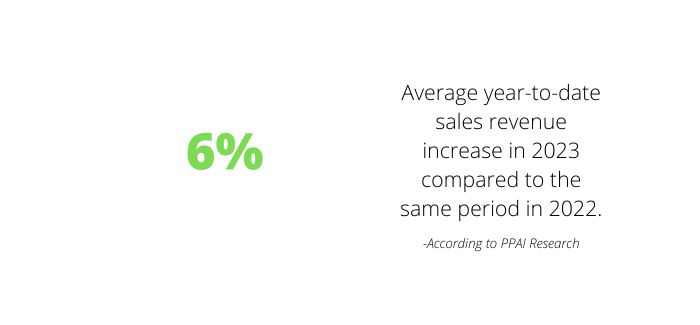

Another telling result from the survey asked respondent to share any year-to-year percentage change in their revenues in 2023 to date. On average, responding suppliers reported a 6% increase in their 2023 revenues.

- 73% of respondents reported some degree of sales increase in 2023 compared to the same period in 2022.

The positive outlook doesn’t come from suppliers alone. In April, PPAI Research reached out to distributors to learn how the first quarter of 2023 had performed for them. The survey found:

- 78.1% of respondents said Q1 2023 business was up compared to Q1 2022.

- Respondents reported an average increase in revenue of 11.3% over Q1 2022.

It’s important to bear in mind that neither the Q1 distributor survey or the newer data, collected two months into Q2, represent approximations of the industry’s overall growth rate, since neither weight the results based on company size, unlike the annual Distributor Sales Volume Estimate.

Rather, both figures should be seen as timely directional indicators that the industry is settling back into a more normalized business flow.