PPAI Research: Q1 Survey Indicates Strong Sales To Begin 2023

Can 2023 follow up the momentum from the promotional products industry’s record-breaking year in 2022?

The numbers from 2022’s Sales Volume Estimate (collected by third-party research firm Relevant Insights on behalf of PPAI) were so eye-popping, it begged the question of whether 2022 was a sign of sustainable growth or more a product of unique factors like inflation and surplus marketing budgets.

As the industry wrapped up Q1, PPAI Research reached out to member companies to get a sense of what 2023 has looked like for them so far.

The Q1 Survey Results

The participating distributorships in this Q1 survey represent companies of all sizes – from some of the industry’s largest distributors, to others who may engage in promotional products on as a side business or retirement job.

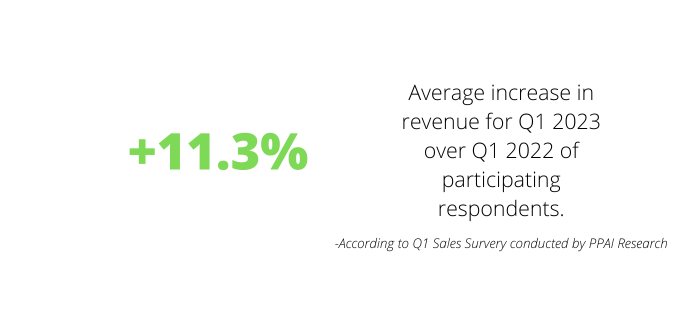

- Respondents reported an average increase in revenue of 11.3% over Q1 2022.

For these companies, following a strong year with double-digit sales growth likely provided some confidence in the state of business.

- Results showed that 78.1% of respondents say business was up in Q1.

- Among those who did not experience business growth in 2021, 14.3% of distributors surveyed say it dropped, while 7.9% reported that business was essentially flat.

These numbers are based only on information from respondents in this survey, which represents a smaller sample size than PPAI’s year-end Sales Volume Estimate. The annual Sales Vole Estimate takes a different approach, with the goal of making a directionally accurate conclusion on the actual size of the industry over the course of a full year.

2022 Was A Tough Year To Beat

The Q1 sales survey results are an average of the respondents’ results and not an overall industry performance estimate. However, sales growth among any sample size of distributors can be viewed positively.

- The 2022 Sales Volume Estimate reported a 15.6% increase in industry sales compared to 2021.

One factor to consider about this Q1 survey is that its numbers are measured against Q1 of 2022.

- Economically and globally, 2022 was a rollercoaster year, with each quarter affected by various factors.

- For some distributors, Q1 may not have been their strongest quarter of 2022, as the global supply chain was still much more of a limiting factor for some distributors.

- On a positive note, inflation may not deserve as much credit for the industry’s growth over Q1 as it did during the course of 2022. The U.S. Department of Labor last week reported that inflation averaged 5.8% during the first three months of this year, compared to almost 8% in Q1 of 2022.