Final Report: Sustainability Surges In 2022 PPAI Sales Volume Estimate

When PPAI Magazine published the findings of the 2021 Distributor Sales Volume Estimate, there was blunted optimism regarding promo’s recovery from the losses of 2020. The caveat was in the numbers: Small businesses seemed to be getting left behind.

A year later, things are more than just looking up. The 2022 findings show a record year for promo, and the healthy return of small businesses played a part in that growth. Promotional products reached $25 billion for the first time ever.

And average distributors have nearly evened the playing field on their larger corporate competitors. For 2022, distributorships reporting less than $2.5 million in revenue made up 46.8% of the total sales volume. One lesson seems clear from the most positive Distributor Sales Volume Estimate in recent years: There are more than enough promo sales to go around.

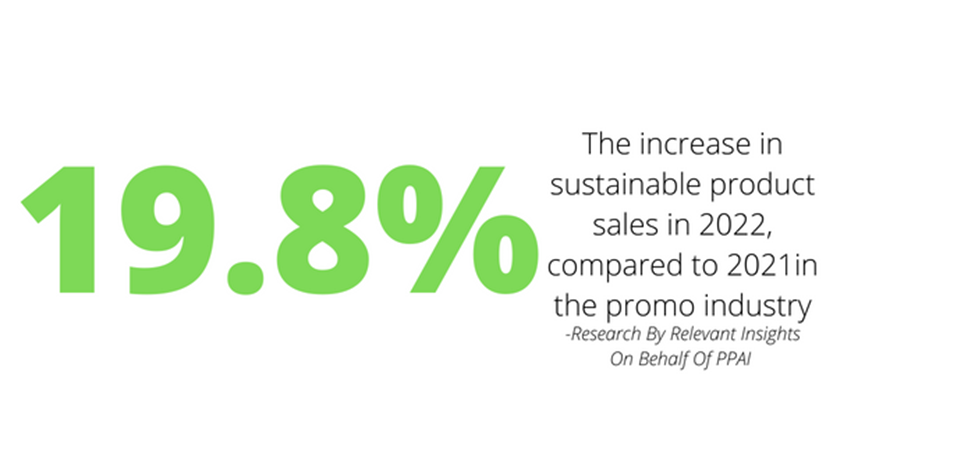

More than that, the future of the industry once again appears secure in another key way: the surge of products sold on the grounds of their sustainability, which leapt nearly 20% from 2021 figures. As consumers increasingly demand products that will have minimal effect on the environment, promotional products distributors are finding answers and shaking off key criticisms of the industry.

For more than 50 years, PPAI has been collecting, analyzing and reporting distributor sales, and this study is considered the most definitive and comprehensive of its kind in the industry, useful in understanding the current landscape for promotional products companies and as a potential tool in any attempts to try to prepare for the future.

Key Findings

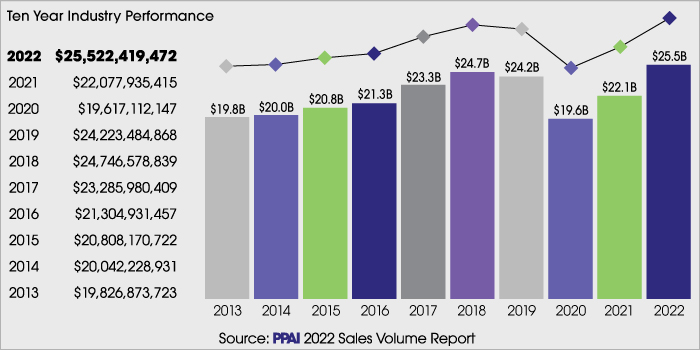

Perhaps the most glaring number in the 2022 findings is the largest one. The total sales of promotional products reached $25.5 billion, surpassing sales from 2018 and accounting for the highest number in promo’s history. These numbers suggest that promo is no longer just rebounding. It’s growing.

The total sales number is a 15.6% increase over 2021’s numbers, which were a 12.5% increase over 2020, a year of sagging performance in the face of Covid shutdowns.

All told, no year on record has even produced within $1 billion of the total promotional products sales reported for 2022.

Company Size Comparisons

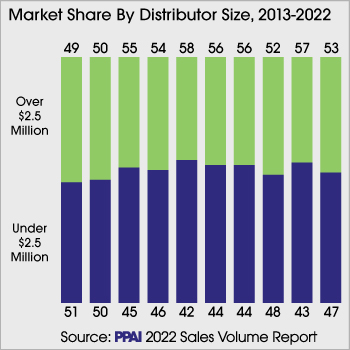

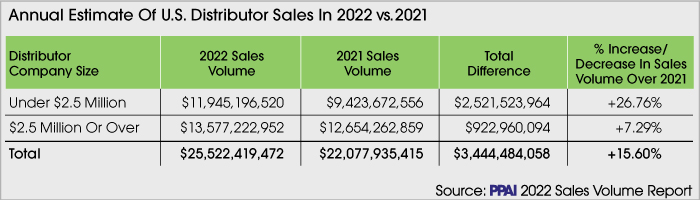

In 2021, only 42.7% of promo’s total volume sales came from small businesses – companies reporting under $2.5 million in annual sales – a concerning trend coming out of a global pandemic in which it seemed conceivable that only the largest companies might survive.

That trend changed course in 2022, with smaller companies reclaiming 46.8% of total volume sales.

The fear coming out of last year’s report was that smaller companies might not have been able to sustain the financial blow that 2020 had served the industry. The other side of that coin, however, is that the farther the industry got from 2020’s economic conditions, it would be the smaller companies that would benefit most, which they did, accounting for $11,945,196,520. This was within $2 billion of large companies’ total sales. Both experienced positive growth.

A deeper look at the total sales volume broken down by company size actually suggests a return of the industry’s middle class. By far the largest percentage of 2022’s sales came from companies that report between $1 million and $2.5 million in annual sales, which accounted for nearly $6 billion in total sales, more than doubling every other company size range. Sales from companies in that size range had a 67% increase compared to 2021, making up a large portion of 2022’s record year.

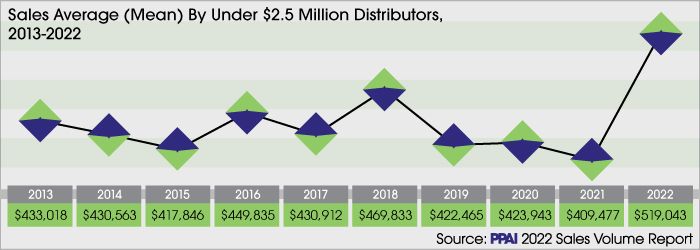

While the smallest companies still experienced some struggles, the sales average, or mean, for the under $2.5 million companies that the survey considers small was $519,000, a higher average than any in the past 10 years and over a $100,000 increase over 2021.

What Part Did Sustainable Products Play In The Rise?

Most of the promo world would agree that sustainable products are going to continue to play an increasingly important role in the industry’s future. With longer lasting, sustainable products often coming at a higher price point, it’s an important area to watch in the Sales Volume Estimate survey going forward.

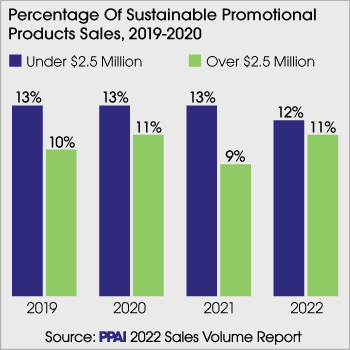

Indeed, 2022’s sales of sustainable products increased 19.8% from 2021 to just under $3 billion. This accounted for 11.2% of the industry’s total sales.

Almost all of large distributors (97%) reported to have sold sustainable products in 2022, while 82% of small distributors utilized this market, a slight uptick from 2021.

These numbers show progress for the industry. The $1.5 billion of sustainable products sold by large distributors surpasses 2019’s report, and it is especially promising that small distributors are keeping pace, accounting for $1.3 billion. One might expect our industry’s largest companies to lead in terms of sustainability initiatives – they have the resources to take chances and have a larger public-facing brand reputation to consider. But the fact that the 2022 numbers approach a near 50/50 split in sustainability numbers between small and large companies suggest that smaller companies want to do the right thing for the environment and are finding it profitable.

A skeptic might see promo’s record-breaking total sales numbers and point toward inflation’s role in these statistics, and they would have a fair point. However, the Sales Volume Estimate’s promising sustainability numbers are a good counterpoint to that caveat. If promo companies are committed to selling longer lasting, higher quality products at higher price points – and clients and end users continue to value them – then that should continue to bolster total sales numbers.

Another Record Year in 2023?

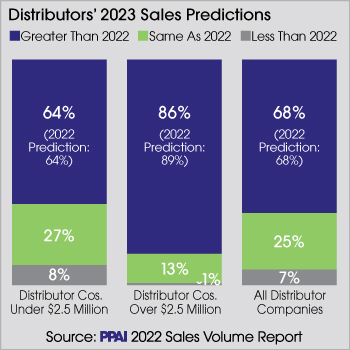

With numbers way up in 2022, optimism about the future isn’t hard to find in the Sales Volume Estimate survey. Of the distributors who participated, nearly 70% expect even higher sales in 2023, meaning we could be living through another record year.

Large distributors are especially hopeful about the current year, with 89% of them expecting higher sales, compared to 64% of small distributors claiming such confidence.

How The Study Was Conducted

To compile the 2022 Estimate of U.S. Distributors’ Promotional Products Sales for PPAI, the survey (collected by third-party research firm Relevant Insights on behalf of PPAI) was distributed both via email to both PPAI member and non-member promotional consultant companies. The sample was drawn from PPAI and UPIC (Universal Promotional Identification Code) lists.

The top 50 distributors were also reached by phone to make sure their information was included in the analysis since the omission of any distributor with a large volume of business could distort the statistics.

Dig Deeper

PPAI conducts the Sales Volume Estimate for the benefit of its members. It paints an interesting and valuable snapshot of the state of the industry, but different points will be of differing value to each company. Feel free to sift through the report yourself by clicking here.