PPAI Research: Benchmarking Supplier Credit Card Fees

In a new PPAI benchmarking survey, responding promotional products suppliers charge distributors an average of 2% for credit card transactions.

In most instances, the suppliers merely pass along the same rates they are charged by credit card companies. The benchmarking information could be useful for suppliers to assess how their rates compare to competitors, or to distributors curious about how the fees they’ve been paying stack up.

- Every time a business accepts a credit card payment, credit card issuers charge a merchant fee.

- Many businesses build these costs into all of their prices, though some apply a specific fee that would not be charged for ACH payments.

- Among supplier respondents, the highest percentage charged to distributors was 5.08%.

Certain responding companies reported that they simply take the hit from the credit card companies and do not pass the price along to distributors. “We consider it good business and a way to get quicker payment,” one said.

Credit card fees are legal in most states. Businesses can charge convenience fees or a surcharge. Customers are charged a convenience fee when they use a form of payment that isn’t customary for the business. This is legal in all 50 states, but it must be clearly communicated at the point of sale and with another preferred form of payment available. Where legal, surcharges must also be clearly displayed at the point of sale and on your receipt.

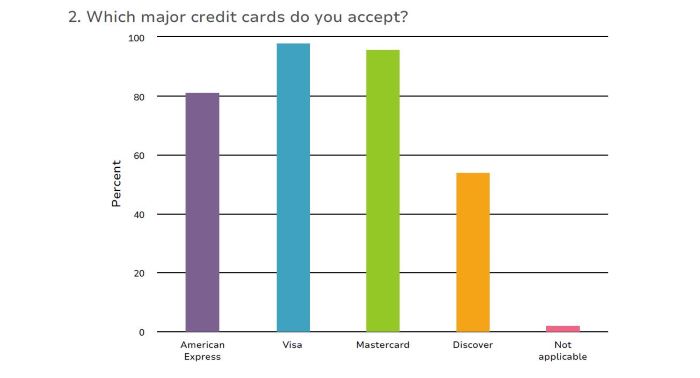

The study found that virtually all (over 95%) of responding suppliers accept Visa and/or Mastercard. American Express is accepted by 81.3% of respondents, with Discover accepted by just over half – 54.2%.

Fees can vary depending on the type of credit card accepted and the type of transaction.

For example, interchange fees are made directly to the card issuer for each swiped transaction and assessment fees are charged monthly to the credit card network so that the merchant can use certain credit cards.

According to Forbes, the typical cost of credit card processing usually combines interchange and assessment fees.

Finally, when we asked suppliers how they arrived at the credit card fee they charge to distributors, an overwhelming number of suppliers stated that they charge what the gateway payment provider charges.

“Our invoices tend to be rather large, and if someone wants to pay a $10,000 invoice with a [credit card], the cost to us is over $300,” one supplier said. “We cannot afford to absorb that cost and therefore need to charge the customer.”

There are a few ways to avoid these fees like sending a check, asking your bank about an ACH or finding a new vendor. One supplier said, “It’s not every vendor and it’s not every transaction. Find a new vendor. You have options.”

In March, distributors shared how they dealt with credit card fees charged to them by suppliers.