Market to Market: Stake Your Claim

In the insurance market, promotional products can help companies achieve premium profits. It’s only natural to protect and safeguard what matters. One can insure everything from the traditional, such as a person’s home and health, to the downright zany, such as mustaches or fantasy sports wagers. With an insurance policy, you stand ready for whatever may come your way in life—no matter how unlikely it may seem.

That said, it’s easy to understand why the industry is such a consistent and reliable marketplace in which to find new clients and develop existing clients. After all, the concept of insurance dates back to the merchants of Babylon as early as 4000-3000 BC. Modern property and liability insurance began in England around 1711 and in the U.S., Benjamin Franklin organized the first American insurance company, Philadelphia Contributionship, in 1752.

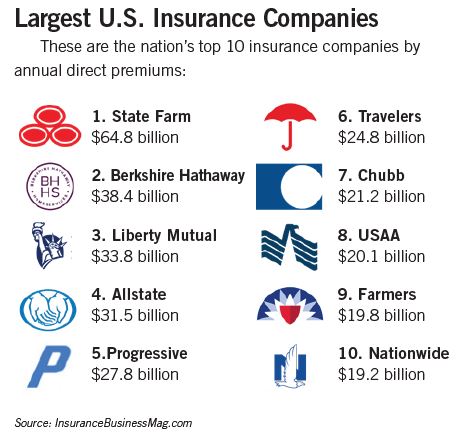

Fast forward 265 years and the options for insurance abound. In 2017, there were nearly 6,000 insurance companies in the United States, according to the National Association of Insurance Commissioners. Net premiums written that year topped $1.2 trillion, with premiums recorded by life/health insurers accounting for more than half (52 percent) and premiums by property/casualty insurers accounting for 48 percent, according to S&P Global Market Intelligence.

The global insurance industry continues to expand each year. In 2017, the industry grew by more than four percent, according to McKinsey, which is the same level as its compound annual growth from 2010 to 2016. Life insurance accounted for nearly half (46 percent) of global premiums, while health insurance remained the fastest-growing segment, achieving five percent year-over-year growth in 2017.

The insurance field is also one of the country’s top employers, boasting a workforce more than 2.7 million employees strong. The U.S. Department of Labor reports that these professionals work for insurance companies, brokers and other insurance-related enterprises.

Among the top purchasers of promotional products, the insurance industry ranks seventh with 4.6 percent of the market, totaling $1.14 billion in distributor sales in 2018. Whether insurance companies want to recruit employees or land policyholders, promotional products are a sure thing. Logoed products gain coveted visibility for brands, establish goodwill and leave a lasting reminder. Whatever companies might encounter in their marketing campaigns, they’re covered with promotional products. Read on for data and trends about this booming market and check out seven selected products to consider for insurance industry clients.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

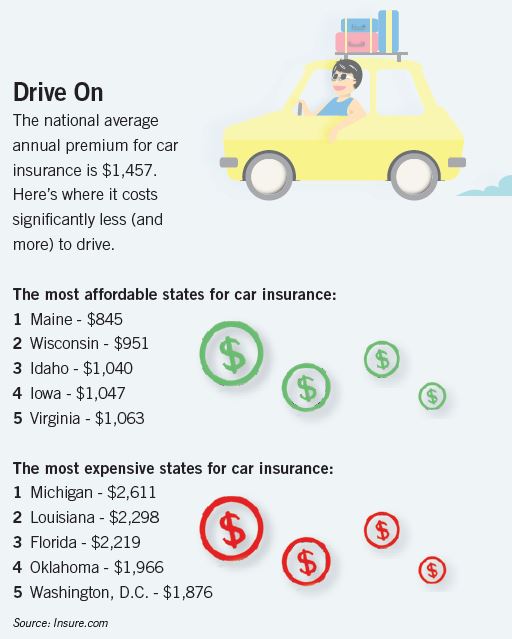

The insurance field is constantly evolving. One major trend is usage-based auto insurance (UBI), which covers how people actually drive rather than how the insurer thinks they’ll drive based on statistics.

Through a telematics device installed in a driver’s vehicle, the insurance company can monitor the policyholder’s driving habits. Both the policyholder and the insurance company win—the driver has an incentive to drive safely, which lowers the number of accidents and claims the insurance company must pay out. The National Association of Insurance Commissioners projects that approximately 20 percent of all auto insurers will offer UBI within the next five years.

Cyber insurance, an insurance product that protects businesses and individuals from internet-based risks, is also on the rise. Cyber premiums in the United States hit $1.84 billion in 2017, a 37-percent increase compared to the previous year, according to insurance company Aon.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

With its unique finish, the heathered hard-bound JournalBook is an eye-catcher in the office or at insurance seminars. It includes a color-matched elastic pen loop, elastic closure and ribbon page marker.

Leed’s / PPAI 112361 / www.leedsworld.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Insurance companies can cover their clients in any weather with the auto open/close super mini umbrella. This compact, lightweight umbrella features Rain Alertz technology, an app that notifies the user of impending rain shower.

AAA Innovations / PPAI 110972 / www.aaainnovations.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Showcase your client’s brand in brilliant color with the Vynex Heavy Duty Hard Surface Mouse Pad. It’s printed using a four-color process and offers a large imprint area.

DIGISPEC / PPAI 180432 / www.digispec.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Insurance professionals can represent their company with flair through custom-designed ties, scarves and jewelry. Use them as thank-you gifts or part of a client’s recognition program.

Diane Katzman Design / PPAI 396045 / www.dianekatzman.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

A fun and smart gift from health insurance companies, the best-selling book Eat This, Not That highlights healthy food swaps for dining in or out.

The Book Company / PPAI 218850 / www.thebookco.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

With the patriotic desk pad, insurance companies can keep their message visible all year long. This 13-month calendar desk pad features months, dates and a bottom reference calendar printed in red and blue.

Drum-Line / PPAI 102565 / www.drum-line.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

With an internal 15-inch laptop sleeve, four zippered pockets, a side water bottle pocket and fully padded shoulder straps, the JanSport Fremont Laptop Backpack is destined to become a favorite while keeping your client’s logo front and center.

Starline USA, Inc. / PPAI 112719 / www.starline.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

As the insurance market embraces technology trends such as web chatbots for customer interactions and automation for faster claims, insurance companies and agents can use promotional products to provide a personalized touch.

Ernst & Young finds that the average retention rate for most insurance companies is about 80 percent. Twenty percent of customers end their relationship with their provider after one year and switch to a different company. To attract and retain customers, consider using promotional items to:

Provide an exceptional customer experience. Just like any other relationship, people want to work with insurance agents they like and trust. By sending surprise promotional gifts in the mail or dropping in with logoed products for the office or vehicle, insurance companies can add an element of delight to an otherwise routine transaction.

Provide an exceptional customer experience. Just like any other relationship, people want to work with insurance agents they like and trust. By sending surprise promotional gifts in the mail or dropping in with logoed products for the office or vehicle, insurance companies can add an element of delight to an otherwise routine transaction.

Engage policyholders. Insurance providers can get to know the people they protect through surveys and polls. As a thank you for participating, consider giving or sending a promotional item.

Increase visibility in the local community. Whether sponsoring a school sports team or setting up a booth at a local fair or event, insurance agents can build goodwill right in their own neighborhoods. Incorporate promotional products to ensure attendees and community members come away with something fun or useful.

Celebrate loyalty. Insurance companies can turn to promotional products to show their gratitude for long-time clients. Giving a thoughtful promotional gift is a way to express appreciation and fortify the relationship.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

1. Wedding insurance –

If the bride and groom must cancel the big event due to a natural disaster or personal tragedy, this insurance protects against financial losses.

2. Change of heart coverage –

If the bride or groom gets cold feet, this insurance covers the cost of the wedding.

3. Alien abduction insurance –

More popular in Europe, where one insurance provider sold more than 30,000 policies, this insurance safeguards against UFOs and alien abduction.

4. Lottery insurance –

If you run a business and all your employees hit the jackpot and resign, this insurance has you covered.

5. Multiple birth insurance –

Parents-to-be purchase a premium at the time of pregnancy. If they have twins, the policy pays out in cash to compensate for the costs of extra babies.

6. Bed bug insurance –

Most renters’ and homeowners’ insurance policies don’t cover bed bugs. This coverage gives peace of mind should the pests appear.

7. Food truck insurance –

Separate from restaurant insurance, this coverage protects food trucks against liabilities such as kitchen fires and foodborne illnesses.

8. Body part insurance – You don’t have to be a celebrity or a pro athlete to protect a face or an arm that’s your money-maker.

9. Chicken insurance –

While traditional pet insurance policies cover traditional pets such as dogs and cats, this insurance covers unexpected expenses for unconventional pets such as chickens and livestock.

Source: PolicyGenius.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

These are the biggest trends insurers are watching over the next three years:

- Customer-facing blockchain – 53%

- Internal blockchain applications – 50%

- AI-based technologies to improve client-facing processes – 47%

- Data analytics – 43%

- AI-based technologies to improve operational processes – 37%

- Cloud-based technology to improve operational efficiency – 30%

- Agile development – 27%

- Cloud-based technologies to generate business value – 13%

Source: Accenture

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Audrey Sellers is a Dallas, Texas-area writer and former associate editor for PPB.