PPAI Research Suggests Industry Sales Are Stabilizing

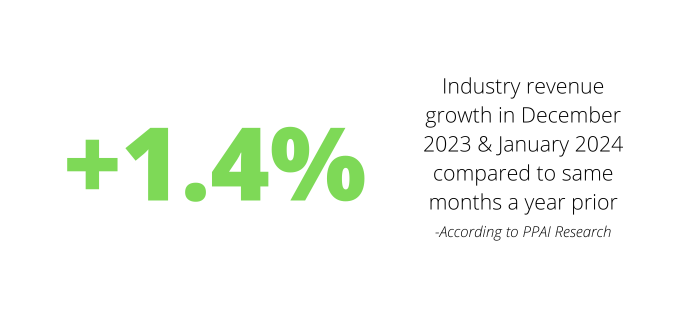

For the first time since summer 2023, the promo industry’s revenue growth over a two-month period has exceeded the growth rate of the previous two-month period. According to a survey of PPAI 100 companies conducted by PPAI Research, industry revenue grew at a rate of 1.4% in December 2023 and January 2024 compared to the same months one year prior.

- These findings mark an end to a slide in the growth rate during the second half of 2023, which culminated with less than 1% revenue growth in October and November.

- While these numbers represent a positive trend, that level of growth is still firmly below the rate of inflation, which has remained above 3% since March 2021 according to January’s Consumer Price Index report, which puts a damper on positive growth numbers.

- The latest revenue data isn’t cultivated from the same methodology as the annual Distributor Sales Volume Estimate, which polls distributors of all sizes. Rather, the current assessment is discerned from aggregated results of PPAI 100 suppliers responding to a flash survey.

“While slight, this growth signals some reason for optimism that a softer Q4 2023 may not solidly foretell an impending downturn,” says Alok Bhat, market economist and senior manager of research at PPAI.

Bhat’s confidence is based on findings within the report, which show an increase in both order volume and unit sales among both distributors and suppliers, “suggesting that not only are more orders being placed, but the size of these orders is also growing.”

This evidence of a “dual growth trajectory” bolsters optimism that there is a robust and growing demand for promotional products and strong consumer confidence in the industry. While every company has to navigate its own strategic operations carefully, Bhat suggests these are conditions that might be prime for market expansion and optimizing operations.

“Companies are encouraged to capitalize on these upward trends, with an emphasis on fostering innovation and maintaining customer loyalty, as strategic measures to adeptly manage any forthcoming shifts in the market,” Bhat says.

Lori Bauer, CEO of iPROMOTEu, says that the distributor has outpaced this growth rate but says that for an industry average, this number is a promising sign.

"Promotional products have consistently proven to be an unmatched marketing medium when it comes to brand exposure and return on investment, including during times of economic uncertainty," Bauer says. "It is positive to see the recent industry growth, evidence of a rise in consumer confidence."

Supplier Challenges

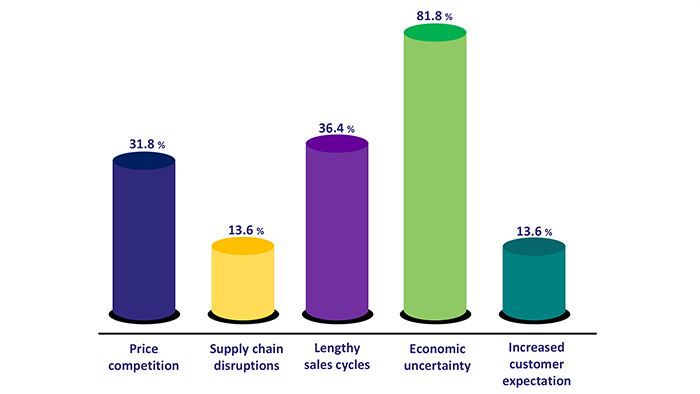

A clear majority of participating suppliers (82%) cited economic uncertainty as a current business challenge.

- This number has yo-yoed a bit over the past six months but remained a top concern for most suppliers. In August and September of 2023, a nearly identical 82% cited economic uncertainty. That number shot up to 91% in October and November before returning to 82% in the most recent report.

- Industry suppliers continue to assert that macroeconomic fluctuations and market instability are a hindrance affecting their strategic planning.

“There is uncertainty stemming from the mixed economic messages we hear and read on a weekly basis,” says Scott McFadden, CFO of Bag Makers. “Bag Makers has good communication with supplier and vendor partners about any challenges they may be encountering. However, sometimes situations change, and we have to adapt accordingly.”

^Business challenges reported by PPAI 100 suppliers in December 2023-January 2024.

Lengthy sales cycles (37%) and price competition (32%) both represent common business challenges reported by PPAI 100 companies participating in the survey. It’s possible these types of frustrations stem back to the most universal of problem, as the unpredictable economy can lead to cautious spending decisions by clients, ultimately trickling down and affecting the time it takes to turn leads into sales.

- Meanwhile, price competition, which is a reported challenge for roughly a third of participating companies, may reflect the competitive pressure within the industry, demanding companies offer value while maintaining profitability.

McFadden says that Bag Makers has been able to hold pricing for a number of products at the same point they were at in 2023, but says, “We recognize pricing is definitely a concern from distributors and end users.”

The supply chain has maintained at a moderately low level of concern (14%), but it is something to keep an eye on. Earlier this month, PPAI Media covered the seven supply chain trends in 2024 that promo companies will have to stay nimble in order to avoid logistical nightmares.

- Some of those trends will be worth monitoring, as they may indicate a new future, such as the Chinese economy and the fact that for the first time in 20 years, the U.S. imported more goods from Mexico than it did in China in 2023.

- Others will require careful navigation but are still out of the hands of companies in promo, such as the crisis in the Red Sea, affecting the Suez Canal.

- McFadden says that ocean container rates have increased since the beginning of 2024, and Bag Makers is monitoring how rates fluctuate over the next few months.

Distributor Challenges

There is a notable shift in thinking among distributors when it comes to the economy.

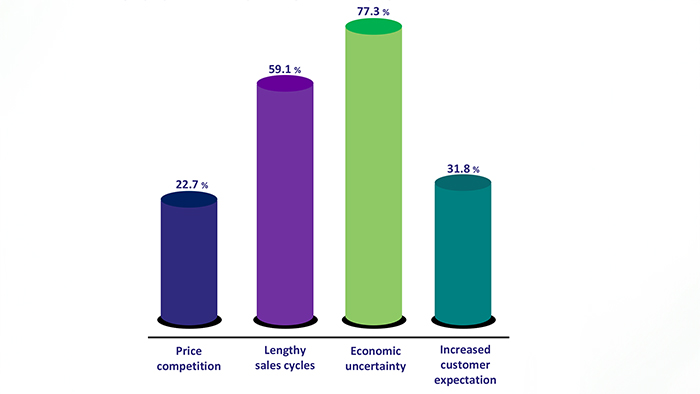

- While economic uncertainty is still the leading business challenge affecting distributors, the number of companies citing it as a concern (77%) was down significantly compared to October and November (94%).

- This suggests that, while the economy is still on the minds of promo executives, both suppliers and distributors are notably less concerned with the economy than they were in late 2023.

Meanwhile, the majority (59%) of distributors are now reporting long sales cycles as a current business challenge, which is up from October and November (44%). The results highlight distributors’ greater awareness of shifts in sale cycle lengths than suppliers.

^Business challenges reported by PPAI 100 distributors in December 2023-January 2024.

Rising customer expectations remained steady as the third biggest business challenge (32%) among distributors. Price competition, which in October and November had been reported as affecting a third of distributors, has stabilized and is now considered a challenge by only 23% of distributors.

- Unlike suppliers, this two-month stretch resulted in no concerns related to supply chain disruptions, which suggests that distributors are more focused on challenges that are more prevalent in their day-to-day operations.

Overall, navigating these stated challenges may require innovation and agility. Bhat argues that distributor silence on supply chain concerns could signal a coming shift from a mindset focused on existential issues to ones aligned toward strategic growth.