Outlook 2024: Celebrating Promo’s Key Strengths

Editor's Note: In a survey of distributors and suppliers in the fall, PPAI Research sought their perspectives on the present and future of the promotional products industry. PPAI Research used this data to produce a SWOT – strengths, weaknesses, opportunities and threats – analysis of the industry to get a better idea of where it's heading in the next three to five years.

In Outlook 2024, promotional products professionals have identified the most important factors cementing our medium among the most valuable forms of advertising.

While some of these strengths have always been a staple of the industry, others have become more visible in the wake of the pandemic. Leaning into these strengths – and highlighting them as primary talking points with clients – will enable promo firms to remain competitive and relevant in the new year and beyond.

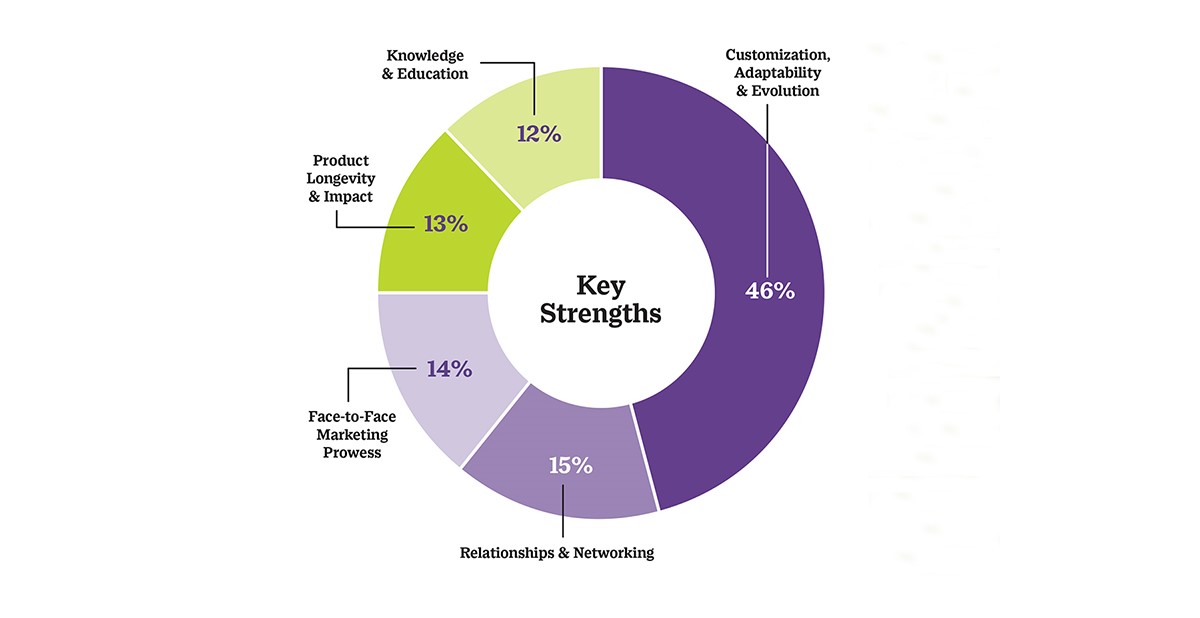

Here are the strengths most commonly mentioned by survey respondents:

46% | Customization, Adaptability & Evolution

Perhaps the promo industry’s greatest strength is its proven track record of adapting to market shifts, technological advancements and general disruption. The same is true of promo companies themselves, as well as the products they create.

Many respondents on both the distributor and supplier sides point to the diversity of products offered in promo, as well as the development and enhancement of decoration methods, as an undeniable strength.

Savvy promo pros have used the vast array of options to ride the wave of advancements in customization and personalization, allowing for tailored solutions to meet clients’ unique needs. “Everyone wants something custom and/or personalized right now. We can achieve that for them,” a responding supplier says.

“While some product categories may stay the same year over year,” a distributor adds, “the way that you can decorate items now is much more impressive and is something you can’t receive when buying a product through retail.”

As for what makes the companies themselves hearty, look no further than the industry’s collective pivot during the COVID-19 pandemic, which included work-from-home accessibility, virtual events and trade shows, supply chain alternatives, drop shipments, online stores and supplying and selling personal protective equipment.

“COVID opened my eyes and changed my perspective on how an industry can survive,” a responding distributor says. “Since then, we’ve navigated government shutdowns, logistic chain blockages, supply shortages, war and recessions.”

Another distributor says, “Our creativity and expertise in promo gives us the ability to be seen by our clients as a value-added partner in business. That partnership allows our clients to focus on what they’re experts in while we focus on what we’re experts in.”

With its adaptability and innovation, the industry can capitalize on trends like eco-friendly products, digital marketing and AI.

The AI adoption rate among PPAI 100 distributors and suppliers is 59% and 55%, respectively, according to PPAI Research.

The majority of both groups (78% of distributors and 75% of suppliers) rely upon AI for content generation for marketing materials.

Thanks to the increasing availability of recognized retail brands in the promo space, the industry is also well-positioned to benefit from the emergence of niche markets and targeted products. “Offering more and more name-brand items that can be decorated,” as another distributor says, provides additional value to end users.

PPAI President and CEO Dale Denham, MAS+, attributes the industry’s adaptability to its “overwhelmingly entrepreneurial” leaders, who consistently bring new ideas to products, services and business operations. However, this also creates a weakness, he says, as most entrepreneurial businesses “hit a wall” where efficiency and scalability become more critical.

“Our industry has reached that point,” Denham says. “PPAI is playing a role in helping drive some efficiency gains that the industry needs to embrace. In addition, we’re engaging our existing business service members and soliciting more to help our industry improve.”

15% | Relationships & Networking

Just as important as the connection between distributors and their customers is the relationship between distributors and suppliers, which underpins a collaborative approach to business.

Both parties understand that they rely on each other to succeed. As one supplier puts it, the industry’s ultimate strength is the “strong collaboration between suppliers and distributors to come up with unique and successful projects for end users.”

“Most members adhere to the three-legged stool concept from many years ago that we each play a part in keeping our industry afloat,” a responding distributor says. For example, “suppliers are becoming more streamlined and faster at providing quotes, order acknowledgments and proofs,” which allows distributors to not only serve end users in quick fashion, but also better manage their expectations.

Furthermore, strong industry relationships and networking can counteract threats from online competition and direct-to-consumer sales models. It’s the “willingness of all members – distributors, suppliers, sales reps, etc. – to help others within the industry” that powers promo’s growth, enabling everyone to get a piece of the $25 billion pie.

“People are more confident working with people who know them and have done good jobs for them in the past,” another distributor says. “It means a lot to be remembered and appreciated by suppliers.”

14% | Face-to-Face Marketing Prowess

Industry leaders have long called for a shift from the mentality of merely selling products to becoming a true partner for customers in their branding journey. That’s why face-to-face marketing efforts that create lasting impressions and foster personal connections with clients is the third most commonly cited strength of the industry.

“We bring trust, authenticity and resilience to our customer relationships,” a responding supplier says.

The industry’s face-to-face marketing prowess also levels the playing field because “small companies can compete with the billion-dollar companies due to years of experience and person-to-person, long-term, repeat sales,” according to a distributor.

However, emerging threats identified in this survey – such as artificial intelligence, online giants and big box retailers – can challenge the strengths of personalized service and industry expertise. Therefore, it’s vital that distributors and suppliers maintain their personal touch and human-to-human customer service to differentiate themselves in the evolving market.

13% | Product Longevity & Impact

“The promotional products industry’s greatest strength,” according to one responding supplier, “is its ability to create lasting brand impressions and engage with customers in a tangible way. When used strategically, these products can play a vital role in a company’s marketing and branding efforts.”

After all, promo products are designed to last, making tactile and enduring brand impressions that digital advertising (or any other of marketing) can’t match. They also have the ability to “physically connect an emotion to a brand, and not just for one brief moment,” a responding distributor says. “When done right, the gift of good promo can be felt for years, even decades.”

End users know and appreciate this, too. In fact, nearly three quarters (74.6%) agree that promo products are a good way to learn about sales and events, and 72% agree that they’re helpful for learning about new businesses in the area, according to PPAI’s 2023 Consumer Survey. Furthermore, 78% of consumers enjoy receiving free stuff from companies and brands they love, and nearly 73% want to receive promo products more often.

12% | Knowledge & Education

Although respondents cite industry knowledge and education as a strength, specifically mentioning PPAI’s vast “network of resources” and penchant for “information sharing,” Denham argues that the industry and the Association need to do a better job.

“We still make ongoing training and onboarding new employees more difficult than it should be,” Denham says. “To address this, PPAI is overhauling all educational content by the end of 2024 and releasing new tracks for industry education, which are free to members, as early as this January. In addition, several business services members are also offering education options.”