‘Guarded Growth’ Leads 2024 Predictions, PPAI’s Bhat Says

Predicting the future is always impossible. And yet it feels even more difficult right now.

Start with the current state of business: Last week, PPAI Media reported its research-backed assessment that the promotional products industry grew just shy of 1% in October and November compared to the same months in 2022. This made that recent stretch the slowest two-month period of 2023 so far.

With promo growth inching across the finish line for 2023, industry distributors and suppliers will be walking a tight rope in 2024. The majority of PPAI 100 distributors and suppliers reported economic uncertainty as a significant challenge this fall. And that uncertainty is beginning to feel rather normal.

“The economic uncertainty trend emphasizes the urgency for companies to develop robust strategies to navigate and mitigate the impacts of an increasingly unpredictable economic environment,” says Alok Bhat, PPAI market economist and senior manager of research, who conducted and analyzed the recent flash poll of the industry’s leading companies.

These conditions are top of mind as the industry looks ahead to 2024.

Suppliers’ 2024 Predictions And Business Priorities

‘Guarded growth’ is a good way to describe suppliers’ picture of demand for promotional products in 2024. There is variance in the degree of growth, but the most common response suggested an expectation for a healthy but not unprecedented bump in demand.

- 39% of supplier respondents predict a 6%-10% demand surge, reflecting overall confidence in steady growth.

- The next most common responses were a bit lower with 28% of respondents predicting a 1%-5% demand increase.

- Another 28% predict the demand will remain flat.

- Just 6% of respondents were truly bullish on the market, predicting a 16-20% increase in demand.

“The 2024 outlook for the promotional products industry suggests ‘guarded growth’ with a focus on incremental demand and market stability,” Bhat says. “Businesses are advised to embrace a dual strategy of innovation and customer-centric growth, while maintaining agility for consistent market performance.’

In terms of what trends will look like in 2024, there is one common response, but there is plenty of room for discussion on what suppliers should be expecting.

“That is the $64,000 question,” one PPAI 100 supplier noted. “No one can read the tea leaves right now.”

- 68% of supplier respondents foresee a greater shift toward eco-friendly products, mirroring a consumer drive toward sustainability.

- 35% expect a spike in unique, tailor-made orders geared toward personalization.

- 23% predict that local products produced in the U.S. will be a focus as global supply chain issues remain prevalent.

- Only 9% of supplier respondents predict a rise in demand for tech-centric promotional items.

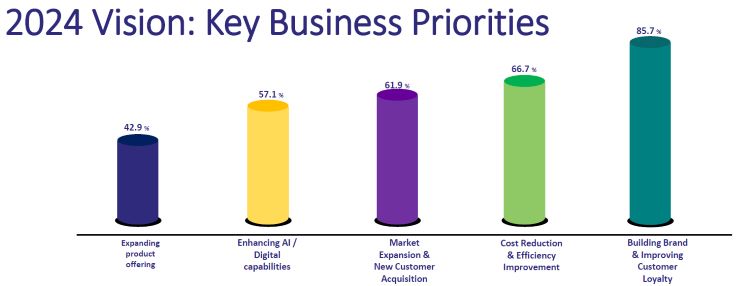

With the course of the economy is in so much doubt, evergreen priorities are ever more in focus. For the majority of suppliers (86%), that means an emphasis on building customer loyalty.

This was the most common answer among suppliers when it comes to their priorities for 2024, followed by two-thirds of respondents claiming cost reduction and efficiency improvements as a necessity.

“This reflects a keen interest in optimizing operations and enhancing profitability in a potentially challenging economic environment,” Bhat says.

- 62% cite market expansion and new customer acquisition.

- 57% intend to focus on enhancing AI and digital capabilities in 2024.

- 43% claim they will treat expanding product offering as a key business priority in 2024.

“2024’s roadmap for the promo industry is sharply defined by a blend of brand enhancement, operational agility, market outreach, digital innovation and product diversification,” Bhat says. “Firms aligning with these trends are setting the stage for resilience and competitive edge in an ever-evolving market landscape.”

Distributors’ 2024 Growth Prediction And Business Priorities

In terms of growth expectations for promo demand, distributors fall in line to a similar expectation as suppliers, practicing cautious optimism, but there are a bit more varying opinions on the distributor side.

- 29% of participating distributors expect a 6%-10% growth in demand for promo products in 2024.

- 24% expect a 1%-5% bump in demand.

- 18% foresee demand being flat, neither up nor down…

- …while another 18% expect an 11%-15% growth of demand.

Then there is an identical minority that expect the two more extreme ends of the spectrum:

- 9% predict demand for promo products will be down 1%-5%.

- 9% foresee demand surging up 16%-20%.

As far as forecasting 2024 trends in the industry, responding distributors aligned with suppliers on the sustainability front.

- 63% foresee a major shift to eco-conscious products.

PPAI’s director of corporate responsibility and sustainability, Elizabeth Wimbush says this aligns with what could be a chance for decision makers to push their organizations to new horizons.

“Sustainability can be intimidating, but it’s important to look at this area as an opportunity for growth,” Wimbush says. “How each company approaches its sustainability goals and what success looks like for them comes with flexibility, based on where their greatest impact potential lies. These differentiators help set them up for new business and give a competitive edge.”

- Further on the list of trends, 43% believe there will be a rise in bespoke and highly customized orders.

- 32% predict a preference for locally sourced USA-made materials.

- 21% foresee an increased demand for tech-oriented products.

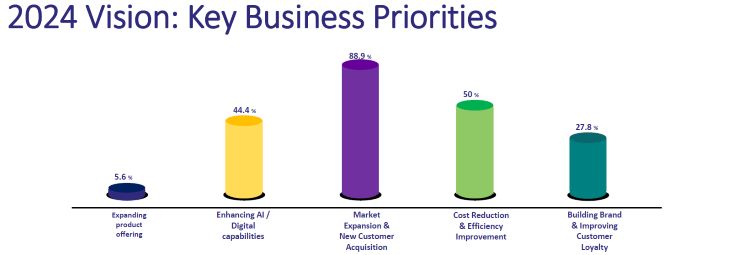

Key business priorities are where distributors differ from suppliers in their 2024 outlook, with distributors eyeing a more aggressive approach.

- 89% of responding distributors cite market expansion and new customer acquisition as a key business priority in 2024.

“This indicates a proactive approach to growth by distributors and an understanding of the need to continually expand the customer base,” Bhat says.

- 50% of responding distributors cite cost reduction and efficiency improvement as a top focus in 2024.

- 44% claim enhancing AI and digital capabilities will be a 2024 focus.

- 28% cite building brand and improving customer loyalty (the most common response among suppliers.

- Only 6% of responding distributors cited expanding product offering as 2024 key priority (compared to 42% among suppliers).

A Look Back

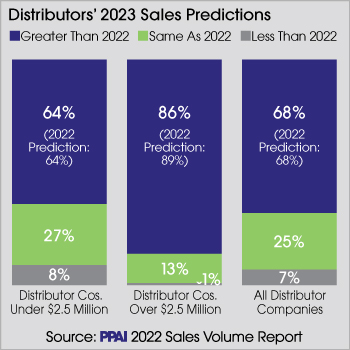

While measuring expectations for 2024, there is no better time to check the industry’s scorecard of predictions for 2023.

With numbers way up in 2022, optimism about the future wasn’t hard to find a year ago, when nearly 70% of distributors said they expected rising sales in 2023. They appear to have been correct, by a relatively narrow margin.

A current rough assessment from PPAI research suggests the industry has grown at just south of 3% year over year through November.