You’ve Been Scammed!

Know The Red Flags Of A Fraudulent Order Before It’s Too Late

Like death and taxes, you can count on scammers. They are present in every industry. Where there is opportunity, there will be always be opportunists, ready to take advantage of lax security and the increasing anonymity provided by digital commerce.

There are a few common scams in the promotional products industry. One of the most frequent scams involves fraudulent orders that are placed with a stolen credit card. The payment will appear to be valid and the distributor fulfills the order, but when the actual credit card holder notices the charge and initiates a charge-back, the distributor loses the payment.

Another type of scam involves identify theft of the distributor or supplier. In some states, scammers may easily access and change company information, such as a mailing address, and use it for their own ends. In one case, a distributor ended up having to fight over $4,000 in phone line charges due to the scam.

How To Identify Scams

While it may be difficult to identify scammers after the deed, let alone prosecute them, there are some consistent giveaways that can tip you off to a potential scam before you become a victim.

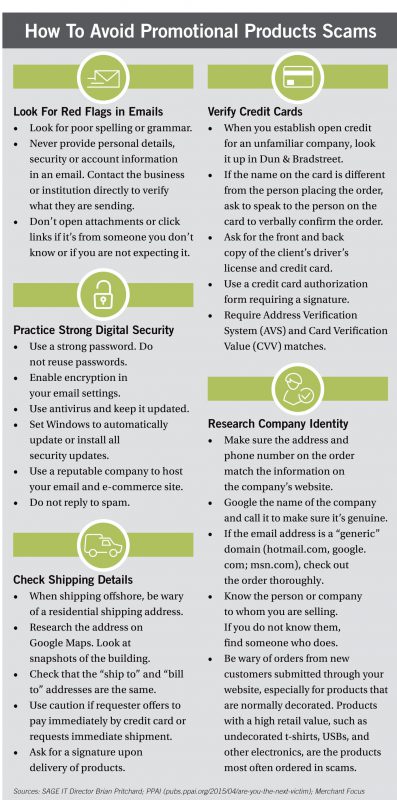

Use these tips from Brian Pritchard, director of IT at SAGE, as best practices for every order. If you see multiple characteristics in an order, it becomes even more important to investigate further.

- Look for poor spelling or grammar. “Usually something will just look strange about the email,” says Pritchard. “Poor English or grammar is a dead giveaway.”

- Notice whether they ask for personal details in an email. “Your bank will never ask for security information or account information in an email.”

- Don’t open attachments or click links if it’s from someone you don’t know or if you are not expecting it. Pritchard cautions, “Even if the email looks like it might be legitimate, contact the business or institution directly from their site. Scammers usually pose as large companies, banks, airlines, shipping companies and large retailers. They may also pose as a customer saying a payment or invoice is attached. Contact the client separately to verify what they are sending.”

- Be wary of orders from new customers submitted through your website. “Popular scams often start with asking for a quote on a large quantity of items. It could be anything, but USB drives and blank shirts are particularly popular.”

- Do not reply to spam. Educate your staff on this practice. “In general, the weakest link in security is the human operator, so vigilance is key.”

- Practice good security measures. He says, “Use a strong password and do not reuse your email password on other services. Enable encryption in your email settings (any email SAGE hosts requires this). Use antivirus and keep it updated, and set Windows to automatically update or install all security updates. Use a reputable company to host your email and e-commerce site like SAGE, which is PCI compliant.”

Here are some of the red flags to look for:

- When shipping offshore, be wary of a shipping address that is a private residence.

Research the address on Google Maps, which often provides snapshots of what a building looks like. Sometimes this step can help filter out fraudulent orders.

- Check the company’s website to ensure that the address and phone number match the information on the order.

- Scammers almost always pay by credit card. Before you establish open credit for an unfamiliar company, look it up in Dun & Bradstreet.

- Be sure the company is legitimate by checking it out on Google and then calling to check.

- Be wary if you get an order from an unknown customer for promotional products that are normally decorated. Products with a high retail value such as undecorated t-shirts, USBs and other electronics are the products most often ordered in scams.

- Generic domain email addresses such as @hotmail.com are often tip-offs to a scam. Check it out.

- Use caution if the requester offers to pay immediately by credit card or requests immediate shipment. This is often a red flag of a scam.

- Know the person or company to whom you are selling. If you don’t know them, find someone you know who does.

Finally, SAGE payment processing partner Merchant Focus shares some helpful recommendations to better identify suspicious cards and prevent fraudulent orders.

- Check that the “ship to” and “bill to” addresses are the same.

- If the name on a card is different from the person placing the order, ask to speak to the person on the card to verbally confirm the order.

- Ask for a signature upon delivery of products.

- Ask for a front and back copy of the client’s driver’s license and credit card.

- Use a credit card authorization form requiring a signature.

- Require Address Verification System (AVS) and Card Verification Value (CVV) matches.

What To Do If You’re A Victim

If you do fall victim to a scammer, there are several steps you should take.

After notifying your bank, credit card company, credit reporting agencies and any other necessary service providers, report the scam to the FTC at www.ftccomplaintassistant.gov and report identity theft at www.consumer.ftc.gov/identity-theft.

Next, alert PPAI at PPB@ppai.org. Sharing your experience will help reduce scams for all members.

You can also stay up-to-date on the latest scams at www.usa.gov/scams-and-frauds and www.consumer.ftc.gov/scam-alerts.

Finally, take steps to educate yourself and your staff. Copy and post the tips sheet on page xx to keep the red flags top of mind for everyone.

Scammers are a threat that will never go away, but with vigilance and knowledge of some simple checks, you can pull a fast one of your own—and leave the scammers out to dry.

Tara is a marketing communications coordinator for SAGE, where she blogs and writes other fun copy (because all copy is fun copy). She believes that owl puns are good puns and has no egrets.