An Uneven Recovery

When PBB published the findings of the 2018 Distributor Sales Volume Estimate, there was an impossible-to-overlook development: Small companies were on the rise heading into 2019. The industry as a whole had a 6.27% increase over 2018, but as was reported at the time, “The growth was mainly driven by sales from small distributors,” who increased both their sales and overall representation in the industry’s makeup.

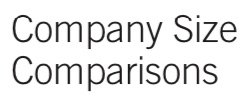

Three years and one pandemic later, that trend has stalled. The 2021 Distributor Sales Volume Estimate showed a healthy increase of (12.5%) in sales volume over COVID-riddled 2020, but the makeup of those gains among small and large companies are quite different. Small distributors were barely able to make it to a sales volume slightly under that of 2020. Only 42.7% of the industry’s total sales volume came from small distributors, which is down from 48.3% in 2020.

For small distributors—companies reporting less than $2.5 million in annual sales—average sales peaked at $470,000 in 2018, then dipped in 2019 to $422,000 and rolled slightly to $424,00 amid the initial pandemic year of 2020. In 2021, however, the group’s average sales dropped to $409,000.

The promotional products industry’s increase in overall sales volume is likely attributed to an increased return to normalcy from 2020, which was more greatly affected by pandemic lockdowns. Demand for personal protective equipment decreased in 2021, and the sales of traditional promotional products picked up.

For more than 50 years, PPAI has been collecting, analyzing and reporting distributor sales, and this study is considered the most definitive and comprehensive of its kind in the industry, useful in understanding the current landscape for promotional products companies and as a potential tool in any attempts to try to prepare for the future.

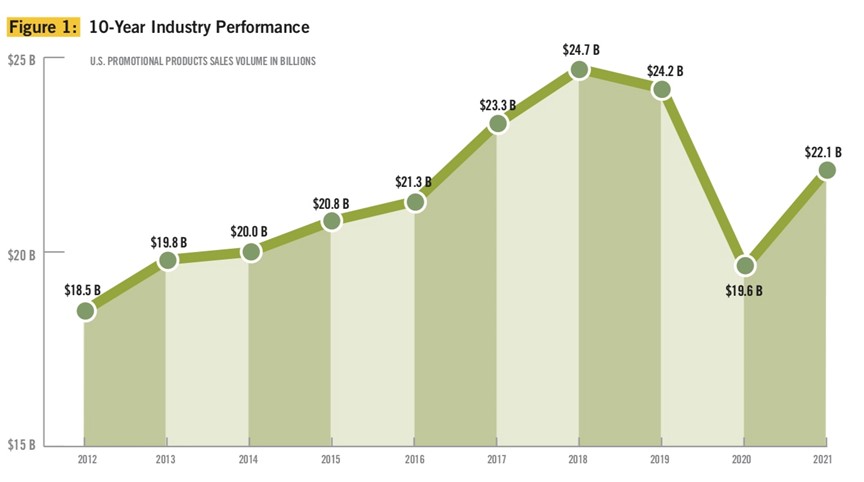

While it’s important to analyze where the increased sales come from, there is no denying that the industry as a whole did bounce back from the tumultuousness of 2020. Promotional products sales by distributors reached $22.1 billion in 2021, up 12.5% from 2020’s $19.6 billion, which had been a sharp decline attributed to the first stage of the pandemic. See Figure 1.

That $22.1 billion in sales is not quite on par with 2018 and 2019 sales totals, which both eclipsed $24 billion. It’s worth noting that while there were some returns to normalcy in 2021 when compared to 2020, the industry still contended with multiple new variants of COVID-19, various economic uncertainties and considerable worldwide supply chain delays.

All told, 63% of distributors reported increased sales in 2021, which could only be said of 20% of distributors in 2020.

There was a sizable difference in growth between the large and small companies in 2021. In terms of sales volume, large distributors experienced a 24% increase. Meanwhile, smaller companies actually failed to reach 2020’s sales levels and saw a 0.46% decrease. See Figure 2.

It is not entirely clear what to fully attribute that discrepancy to beyond the possibility that many smaller distributors continued to struggle with pandemic-related issues, or that they were no longer clients’ preferred partners once restrictions began to ease. Regardless, the report states bluntly that “the growth difference between segments tipped the industry’s balance in favor of large distributors,” which is counter to trends from as recently as 2018. For 2021, 57% of the market share was made up of companies with over $2.5 million in annual profit, which represents the largest percentage in the past decade. See Figure 3.

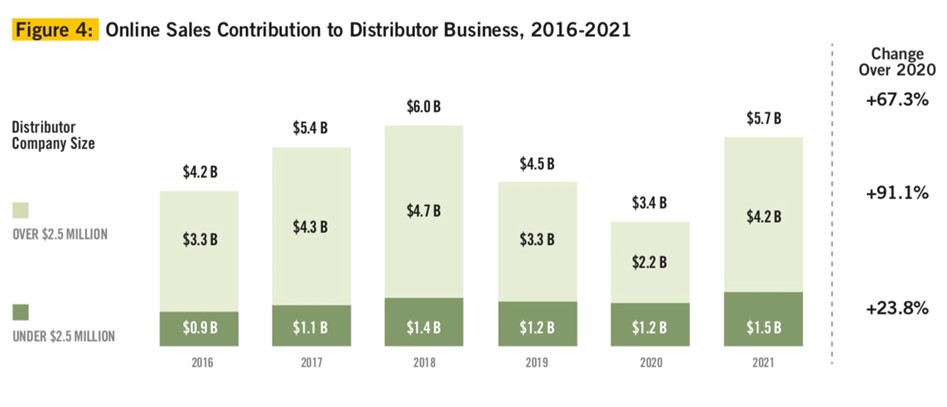

It can’t be overlooked that the share of online sales of promotional products was 25.8% in 2021 (up from 17.3% in 2020). That larger share resulted in a massive increase in total volume of online sales.

Once again, though, that increase was mostly felt by larger companies, which saw a whopping 91.1% increase in online sales. Large companies did $4.2 billion in online sales in 2021 compared to just $2.2 billion in 2020. While small companies saw a much smaller growth in online sales, they still made more in online sales than they had in the previous five years. The total reported online sales from all companies was $5.7 billion, which suggests it is picking up a trend that peaked in 2018 with $6 billion. See Figure 4.

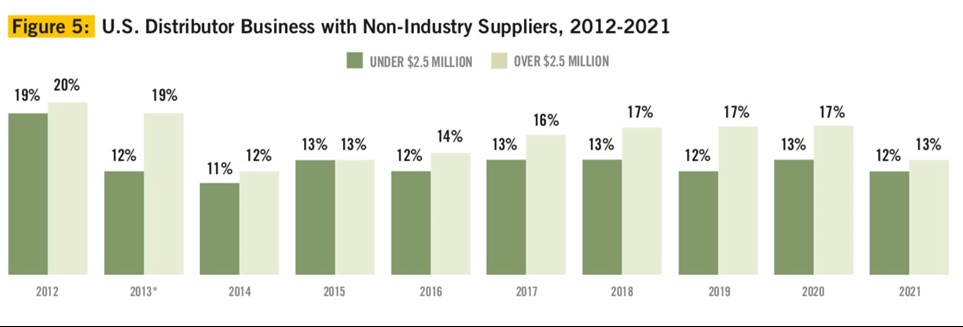

Small distributors continued to do business with non-industry suppliers at a rate on par with 2020, but large distributors only did 13% of business with suppliers outside the industry, down from 17% from 2020. The Internal Survey Report theorizes that this might have been a result of global supply chain issues that came out of the COVID-19 pandemic and which became an increasing obstacle as 2021 progressed. Many supply chain issues that began in 2021 have carried into 2022, and so it is possible that this trend may remain for our current year.

The total number of sales in products from non-industry suppliers came out to $2.8 billion, which is 5.7% less than 2020.

Retail branded products were only introduced to the survey a few years ago. PPAI defines retail branded products as “consumer-facing, brand name products that add a sense of distinction to incentive and recognition programs as well as individual end-user gifts (Yeti, Maui Jim, Inc., TUMI, Nikon, Inc., etc.).”

This applies to the majority of distributors in the industry. The number of distributors selling retail branded products in 2021 was relatively unchanged compared to 2020. Every large distributor indicated they sold them (compared to 97% in 2020) and 84% of small companies reported they did (compared to 81% in 2020.)

There was a slight increase in the actual size of sales that came from retail branded products. The industry sold $4.5 billion in retail branded products, which is a 2.6% increase from 2020 but still nearly $1 billion short of 2019.

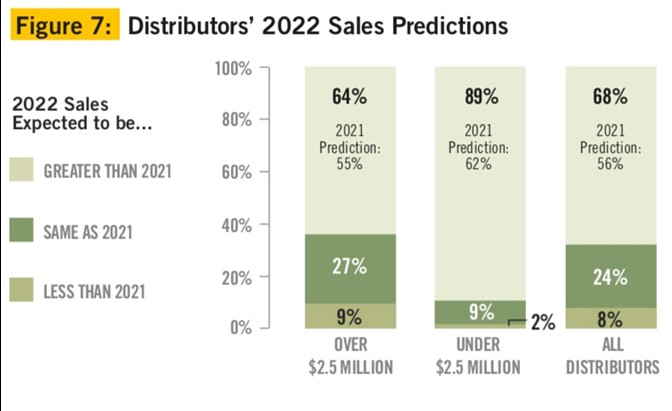

In spite of current economic challenges including prices rising worldwide—see our report on the industry’s reaction to current inflation levels on page 18—the majority (70%) of distributors who participated in the survey expect higher sales and profit for 2022 than 2021 (and 2020). Understandably though, that optimism is stated more strongly among large distributors.

A total of 36% of distributors under $2.5 million in annual sales predicted sales either the same or less than they achieved in 2021. Only 11% of distributors with over $2.5 million in annual sales had as conservative or pessimistic predictions.

Similarly, 77% of large companies predicted greater profits in 2022 compared to only 55% of smaller companies who shared such optimism.

To compile the 2021 Estimate of U.S. Distributors’ Promotional Products Sales for PPAI, the survey was distributed via email to both PPAI members and non-member promotional consultant companies. The sample was drawn from PPAI and UPIC (Universal Promotional Identification Code) lists.

The top 50 distributors were also reached by phone to make sure their information was included in the analysis because the omission of any distributor with a large volume of business could distort the statistics.

Jonny Auping is a news editor at PPAI.